Rates and demand at all-time highs as Year associated with the First-Time Buyer kicks in

- Price of property arriving at market increases by a substantial 2.9% (+£8, 324) this thirty days, striking a fresh record of £299, 287 and surpassing the record set in October 2015 by over £2, 700

- Housing need higher than ever before as Rightmove traffic strikes record amounts, with visits up almost 20% year-on-year in January

- Encouraging 5% uplift in brand new properties coming to industry compared to exact same time last year resulting in the greatest total number of newly-listed properties at this time of the year considering that the 2008 credit crunch

- The entire year of this First-Time Buyer: Government initiatives and low interest perspective now aligning with an increase of home choice for first-time purchasers, with 10% year-on-year leap in the wide range of two beds or a lot fewer arriving at marketplace

Review

Overview

The price of home arriving at market has actually hit a unique record significantly less than two months to the brand-new year’s seasonal upturn. Brand new seller asking rates have increased by a considerable 2.9percent (+£8, 324) this thirty days, regardless of some enhancement within the stability between offer and demand. There's been an encouraging 5percent uplift when you look at the wide range of new properties visiting industry set alongside the previous year, which will help to generally meet a few of the record demand from home-movers. brand new supply of typical first-time customer domiciles has increased most, up by almost 10% this month, a welcome boost alongside various other initiatives for the people looking to get onto the housing ladder in 2016.

brand new supply of typical first-time customer domiciles has increased most, up by almost 10% this month, a welcome boost alongside various other initiatives for the people looking to get onto the housing ladder in 2016.

Miles Shipside, Rightmove director and housing market analyst feedback: “The new year’s marketplace features hit the surface running in many places, continuing final year’s momentum and resulting in the price of home coming to the marketplace striking a brand new large. Numerous agents reported large amounts of sales in November and December and properties offering more quickly, so it’s motivating to see signs of replenishment of residential property, particularly in the first-time buyer industry. But despite the evident veneer of marketplace buoyancy, those considering putting their home on the block must do not be too positive with regards to preliminary asking price, since many buyers are still naturally becoming extremely selective about their future house.”

Record prices and demand with a few recovery in supply:

The previous record price high ended up being set in October 2015 but this has today already been surpassed by £2, 738, pressing the typical new seller selling price to £299, 287. Need for housing as assessed by traffic on Rightmove and enquiries to representatives can also be at record amounts. there have been over 127 million visits to Rightmove in January, up by almost 20percent on January 2015, with phone and mail enquiries to representatives also at an all-time a lot of over 4.9 million within the month.

there have been over 127 million visits to Rightmove in January, up by almost 20percent on January 2015, with phone and mail enquiries to representatives also at an all-time a lot of over 4.9 million within the month.

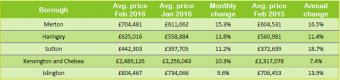

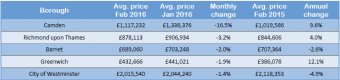

A consistent feature of recuperating marketplace within the last few years has been the method of getting residential property coming to market neglecting to hold rate with need. These day there are welcome signs and symptoms of fresh offer increasing using volume of new properties arriving at industry is at the highest degree considering that the recession of 2008. However, it ought to be mentioned this is patchy by area with only four areas above the 5per cent year-on-year average uplift, namely London, south-east, south-west and Yorkshire & the Humber. When you look at the West Midlands brand-new stock is actually down by 0.3% and Wales and also the North West have observed an uplift of just one% or less, restricting fresh option for buyers within these regions.

Shipside explains: “While even more properties are coming to market discover small anecdotal proof tax-shy landlords attempting to sell up. It is more likely contains extra first-time vendors who're often hoping to bag a buy-to-let investor before the April stamp responsibility hike, or joining others who tend to be deciding that 2016 is the 12 months to trade up. Those trading up are not any doubt urged because of the stable interest rate outlook reassuringly communicated straight from the Governor’s lips.”

Shipside explains: “While even more properties are coming to market discover small anecdotal proof tax-shy landlords attempting to sell up. It is more likely contains extra first-time vendors who're often hoping to bag a buy-to-let investor before the April stamp responsibility hike, or joining others who tend to be deciding that 2016 is the 12 months to trade up. Those trading up are not any doubt urged because of the stable interest rate outlook reassuringly communicated straight from the Governor’s lips.”

The Year of the First-Time Buyer

The sector seeing the highest amount of brand-new properties coming to the marketplace could be the typical first-time buyer property with two bed rooms or a lot fewer, up by 10per cent this month compared to the exact same month just last year. 2016 may be the 12 months of first-time customer motivated by low interest, projects particularly Help to Get, and buy-to-let investors facing progressively damaging taxes.

Shipside observes: “For the 2nd thirty days running the highest boost in availability of houses arriving at market is properties with two rooms or a lot fewer, usually the target buy of first-time purchasers or buy-to-let people. There clearly was a 10% uplift in new offer when compared to exact same period in 2015, indicating all areas have significantly more fresh option inside industry than today last year. Areas outperforming the nationwide average with more than 10% even more newly-marketed domiciles with two bedrooms or a lot fewer are London, East, South East, south-west, West Midlands, and Yorkshire & the Humber, of course this trend goes on the increased competitors among brand new vendors might help to temper price rises. Increasingly More agents are stating a wholesome return in first-time customer figures, along with the cards progressively stacked within their favour 2016 could turn out to be the year associated with first-time purchaser.”

RELATED VIDEO