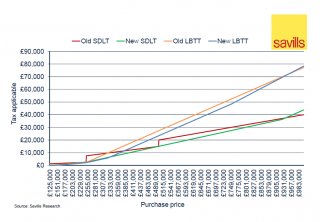

From April 1, 2015, Land and Building Transaction Tax (LBTT) will replace Stamp Duty Land Tax (SDLT) on Scottish home deals. Though its 2 % less than had been feared, it is still 27 per cent more than the SDLT paid by the remaining UNITED KINGDOM.

From April 1, 2015, Land and Building Transaction Tax (LBTT) will replace Stamp Duty Land Tax (SDLT) on Scottish home deals. Though its 2 % less than had been feared, it is still 27 per cent more than the SDLT paid by the remaining UNITED KINGDOM.

LBTT is great development for house ownership generally speaking as it means 50 percent of purchasers will not need to pay residential property tax anyway. But does signify the currently greatly taxed center classes is going to be picking up the tab and therefore could influence the higher end associated with the market.

Large quantities of property income tax are typically related to booming markets, however the Scottish residential property marketplace, though enhancing, is still fragile.

The brand new system depends on 8 % of buyers for approximately 75 % of this tax revenue. When there is any slow down at this degree it'll lead to a considerable fall-in income. It seems unavoidable the threshold for the 5 percent taxation band will have to be extended good remaining UNITED KINGDOM.

Outside London, Scotland is the most sought out area on Savills intercontinental site and, despite higher levels of income tax, it nevertheless offers exceptional price compared to London additionally the south.

Outside London, Scotland is the most sought out area on Savills intercontinental site and, despite higher levels of income tax, it nevertheless offers exceptional price compared to London additionally the south.

For example, around £775, 000 will buy a two-bedroom upstairs flat in Fulham, including SDLT. The same outlay will purchase a four-bedroom Victorian house with landscapes in a comparable Edinburgh area, including LBTT. A bargain in any person's book.

Further information

RELATED VIDEO